Fact: Brands are obsessed with plugging into the Millennial generation. Despite this, it seems that many established companies still struggle with how to create a meaningful connection with this key audience–financial institutions included.

As a result, I performed research around the relationship between Millennials and credit cards, to better understand behavior, attitudes and how Millennials select a card, hoping to develop insight that would help financial institutions build campaigns that resonate.

The big takeaway is that credit card issuers seem to be unsure about how to engage Millennials in their products. As is often the case with what some would consider “bad news,” there is both danger and opportunity in this data: Danger for those companies that fail to change course and engage Millennials, and opportunity for those that can solve the conundrum.

The stakes are huge.

Many companies have realized their future is almost certainly tied to their ability to create a connection with this generation. Millennials, born between 1980 and 2000, now represent the largest segment of the population, one-quarter of all Americans. They’re the largest generation in US history, surpassing even the Baby Boomers. And now, they’re entering their prime spending years.

Do Millennials even want credit cards?

For generations, American consumers fueled their spending with credit cards. It’s a system that works; although there are certainly instances of consumers overdoing it, utilizing credit to build a track record while moving into adulthood is a proven way to responsibly increase purchasing power. Credit has been a key component in the United States building the greatest standard of living the world has ever seen.

However, research shows Millennials seem dubious about the power of credit and credit cards. This has partly to do with the economic landscape of the late 2000’s and early 2010’s when the economy was in decline and the national financial narrative was focused around the debt crisis. Not to mention the 6% increase year-over-year in student loan debt that took place between 2008 and 2012. Your average college graduate now owes approximately $29,400. Millennials have become increasingly weary of inflating their debt and spending money that they don’t have.

Despite these apparent attitudes, there is likely an opportunity for credit card issuers to break through and secure a significant share of this still uncommitted cohort.

Let’s dig deeper into our findings.

Research findings

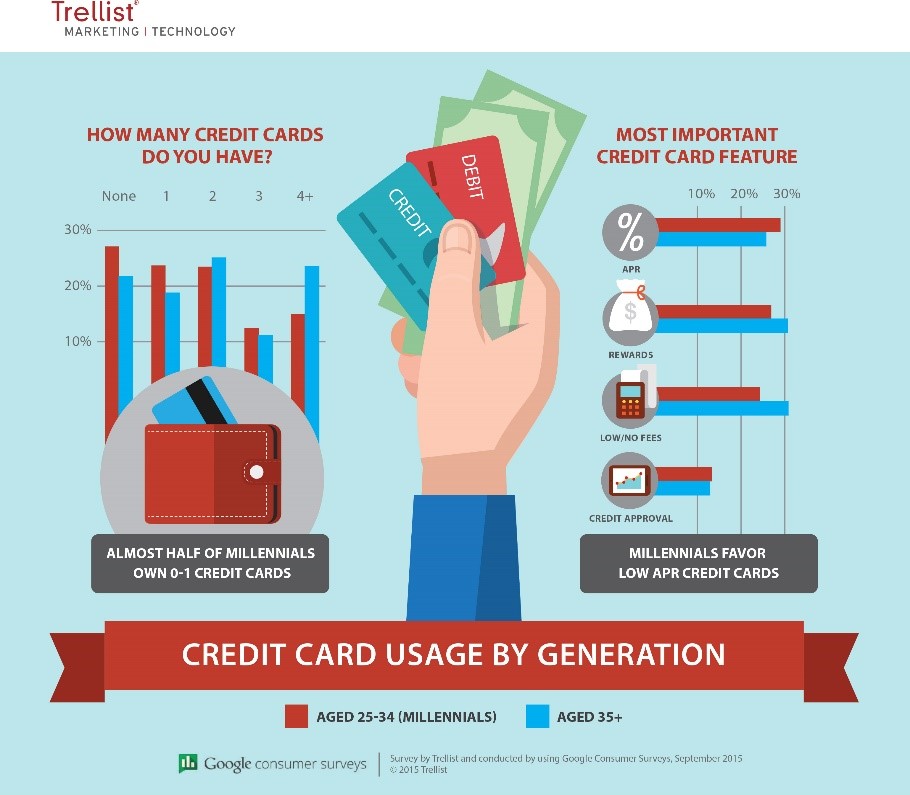

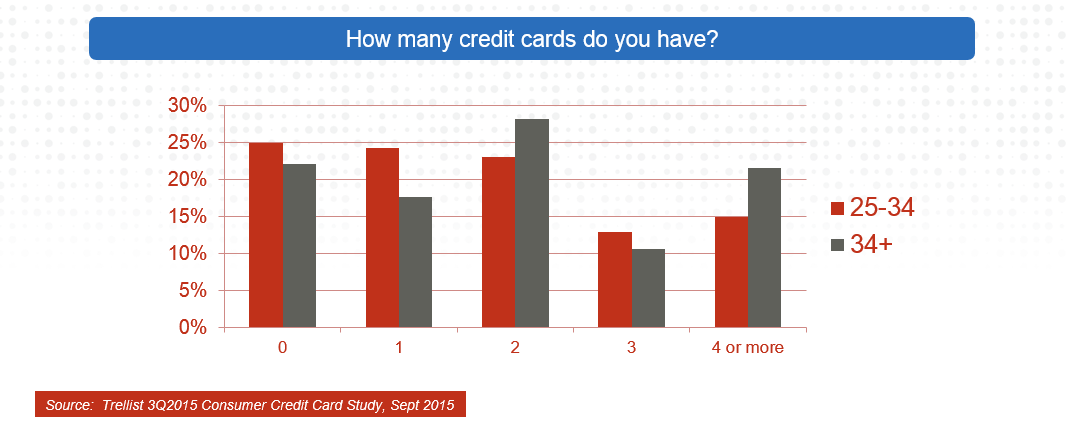

We see the overall number of cards increase with age, 25% of Millennials do not even own a credit card, while almost 30% of those aged 34+ have 2 cards.

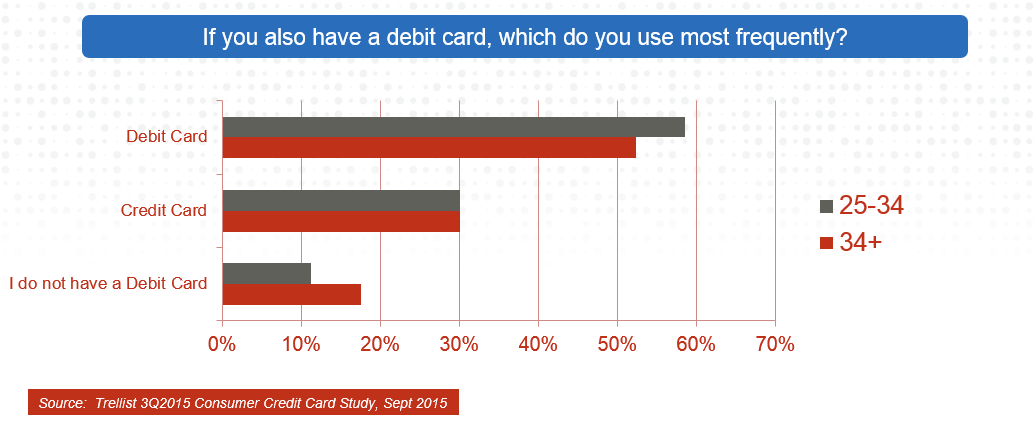

When asked about everyday preference, almost 60% of Millennials said they would use their debit card over a credit card if they possessed one, which presents a large marketing opportunity to change their minds.

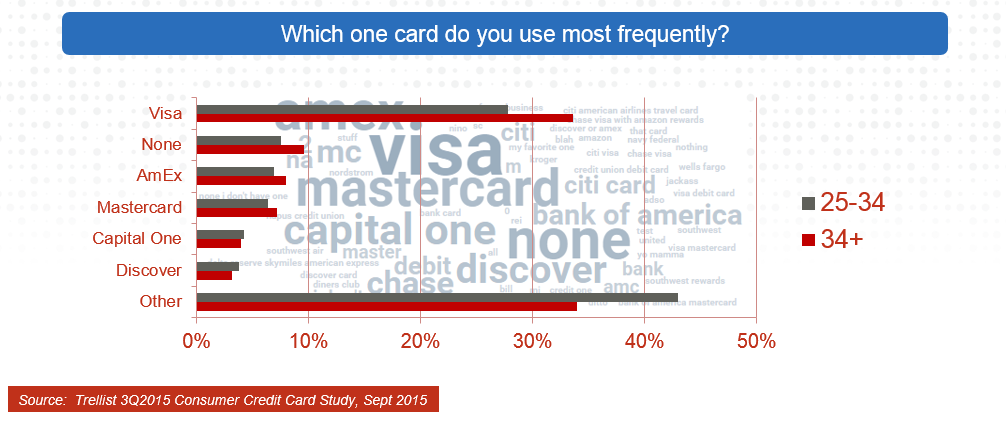

Of the credit cards in their wallet, both Millennials and non-Millennials reach for their Visa first.

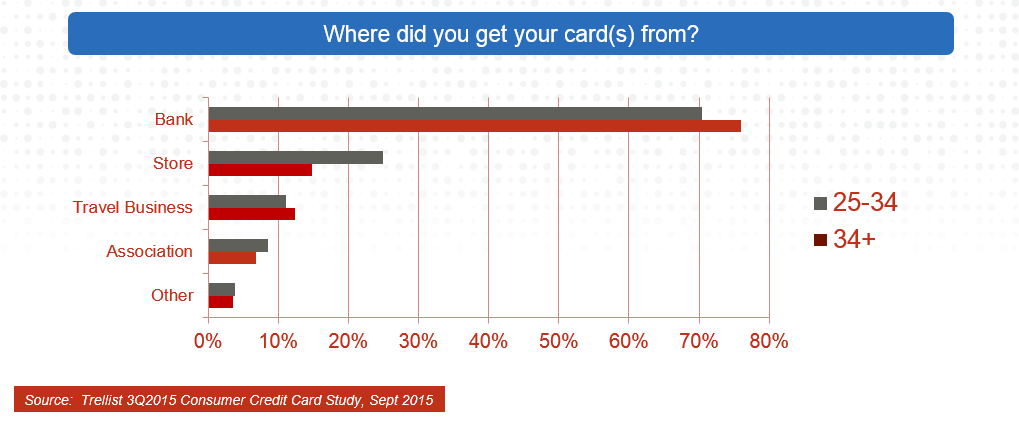

When asked where a credit card was obtained, over 70% of respondents said a bank.

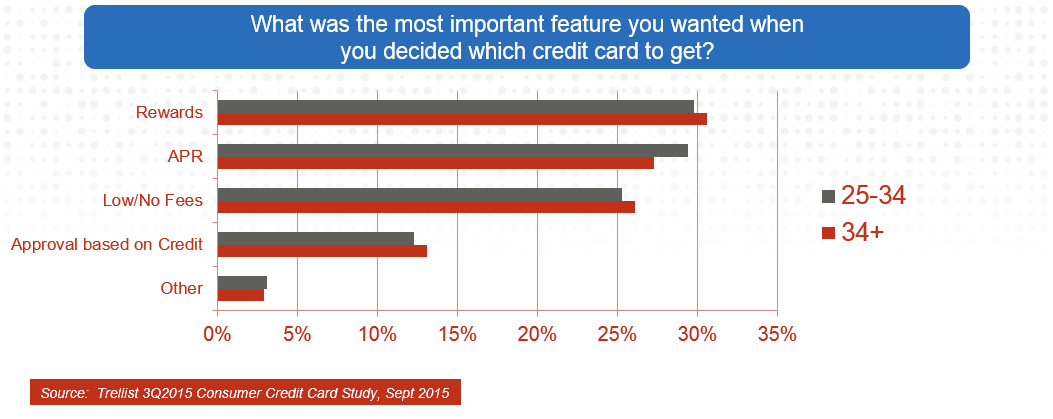

Millennials and non-Millennials were in agreement with the features they preferred when choosing a credit card: Rewards, APR, and Fees.

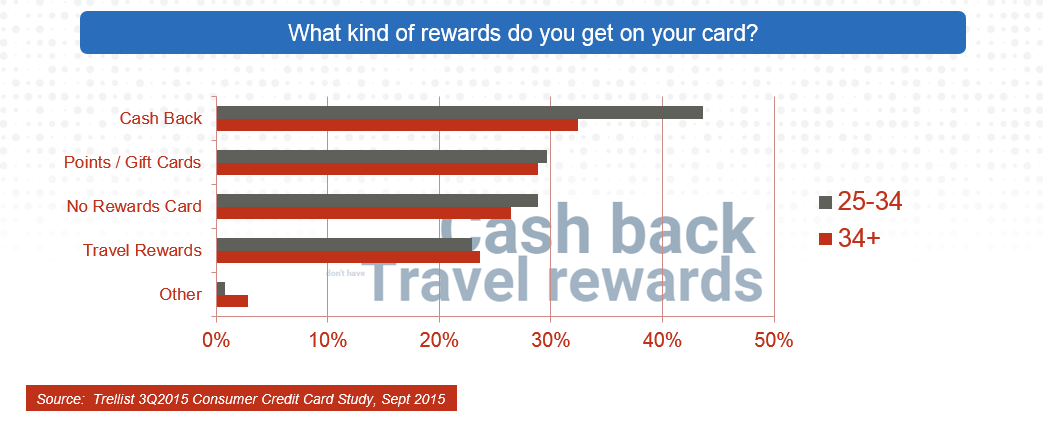

When it comes to Rewards programs, both groups are focused on Cash Back, although it seems far more important to Millennials.

Connecting with Millennials

It is clear that the credit line paradigm is shifting as this new generation enters its prime spending years without leaning as heavily on credit cards as previous generations have. The question is, how can the financial services industry reach this demographic? To answer this question requires examining the efforts of some of the most recognized and successful brands and their strategies to reach Millennials.

Though not in the financial services industry, Uber has been innovative in its approach to marketing to this group. Millennials are not as interested in cars as they are convenience, so Uber capitalized on this trend and incorporated it into their core service. They offered the easiest way to find a ride from anywhere and a simple way to pay for it via a smartphone, having since become a global cultural phenomenon. Uber knew its target market, focused on convenience and offered a unique value proposition.

Another example is Coca-Cola, whose approach incorporating sharing, identity, and personalization has resonated with Millennials. The soft-drink giant launched a campaign that printed 250 of the most popular names among teens and Millennials on 20-ounce bottles of Coke. The intended effect was to bond consumers to the brand by personalizing the product: intrigue, engage, and convert. In addition, a website was created to supplement this initiative with fun facts regarding the names on the bottles. The immediate result was a 2% increase in domestic sales and a wave of positive brand sentiments from consumers.

Conclusion

To prevent the looming financial service industry pitfall that is low adoption of credit cards among Millennials, companies need to rethink their approach to traditional marketing of their products. Creating experiences in which consumers can participate, shareable content, aligning a brand with a cause, personalization, and convenience are essential to reaching this demographic.

Methodology

To collect credit and debit card usage data an online survey was conducted among users of all ages. One thousand responses were collected. The data from the Millennial group, ages 25 to 34, was then compared to the older age groups, 35 to 44, 45 to 54, 55 to 64, and 65+. From this data Trellist was able to answer two key questions: How many credit cards do you have, and what is the most important feature?